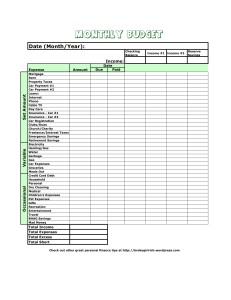

50/30/20: Divide your budget into percentages. Cash Envelope: Separate your money into physical cash in envelopes with labels to keep your spending limits firm.

#Personal budget line items manual#

Manual Budgeting: Good for beginners, this method involves tracking all of your spending and organizing it to understand your finances.

Or perhaps you don’t have children, meaning childcare isn’t an expense for you. Maybe you don’t have any debt, meaning you don’t have to include that on your list. Of course, your list of budget categories may not look exactly the same as the one above. The Bottom LineĪ big part of creating an effective budget is including the correct categories. This would include building your emergency fund, saving for a down payment on a house or car, saving for a vacation and building an education fund for your kids.įinally, this category includes your investment accounts, whether you’re investing for retirement, saving for a major purchase or just investing to build wealth. Next, this category includes any saving you do for financial goals, both short-term and long-term. But you may also make other payments on your debt above and beyond your minimum payment. In other words, your financial goals.Ĭertain debt payments will be mandatory in your budget - those might include your student loan payment or car loan payment.

The final category in your budget should include money that goes toward debt, savings and investments.

0 kommentar(er)

0 kommentar(er)